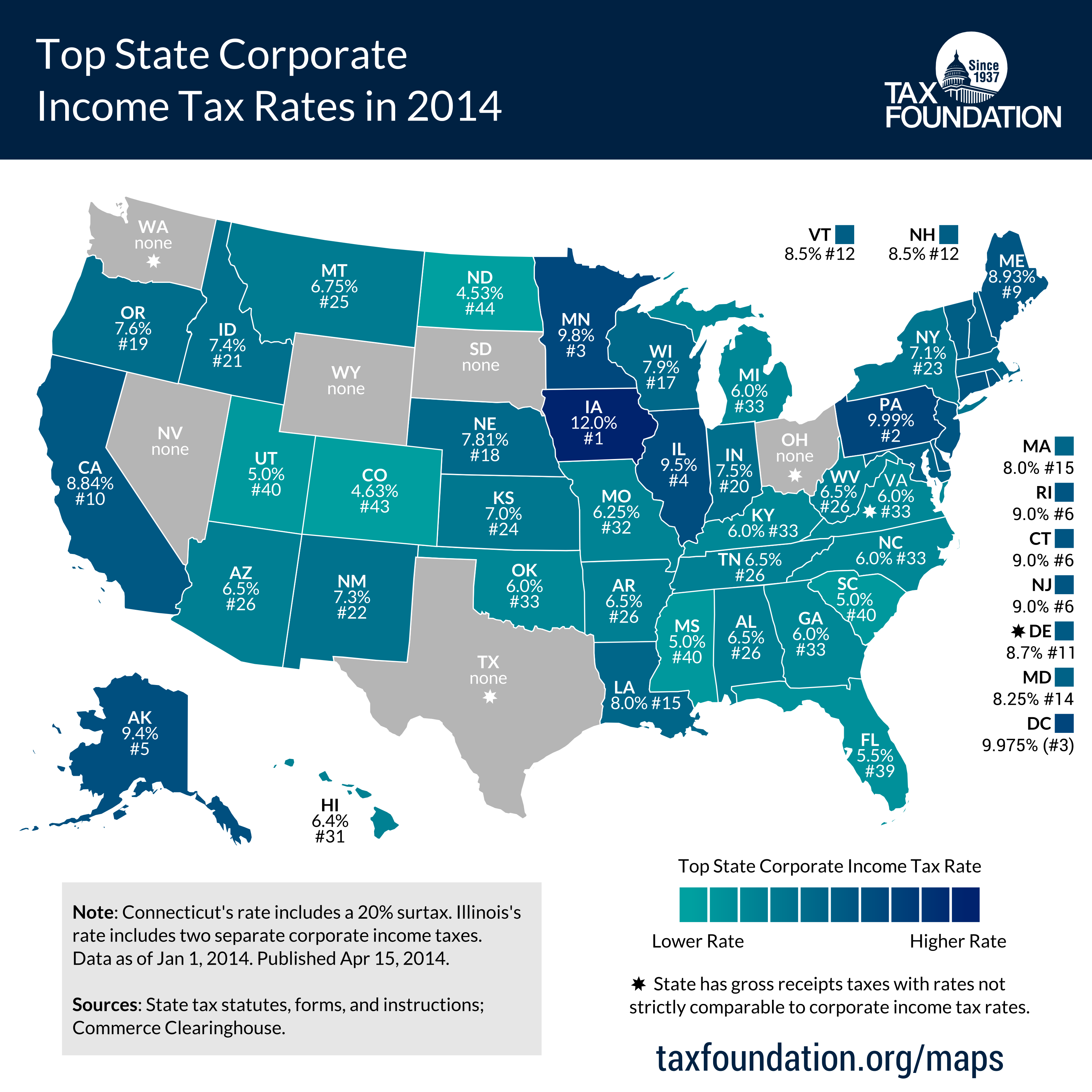

"If you recall, Governor Quinn decided to tax the heck out of the trucking industry"

Can you expand on that? What tax was implemented targeting the trucking industry?

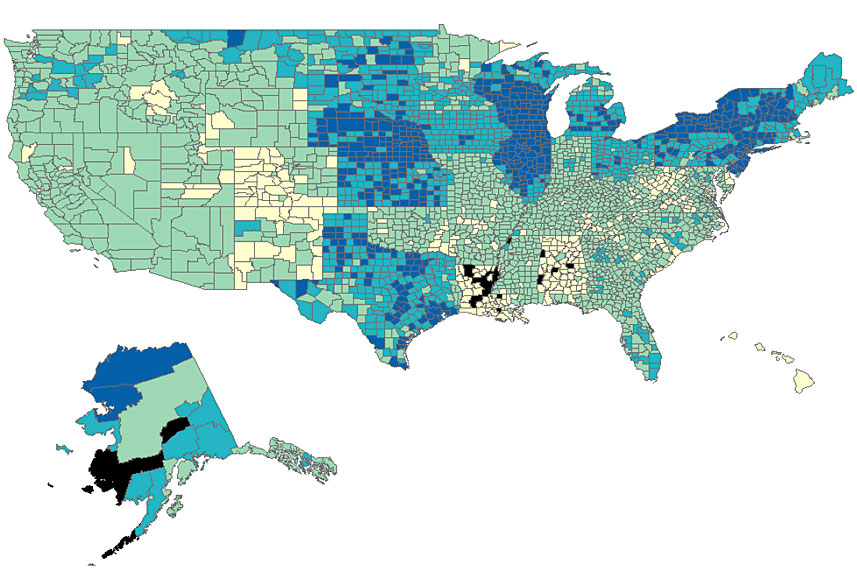

Aren't they going to hurry back to Illinois now that Rauner is elected?

Can you expand on that? What tax was implemented targeting the trucking industry?

Aren't they going to hurry back to Illinois now that Rauner is elected?

Comment